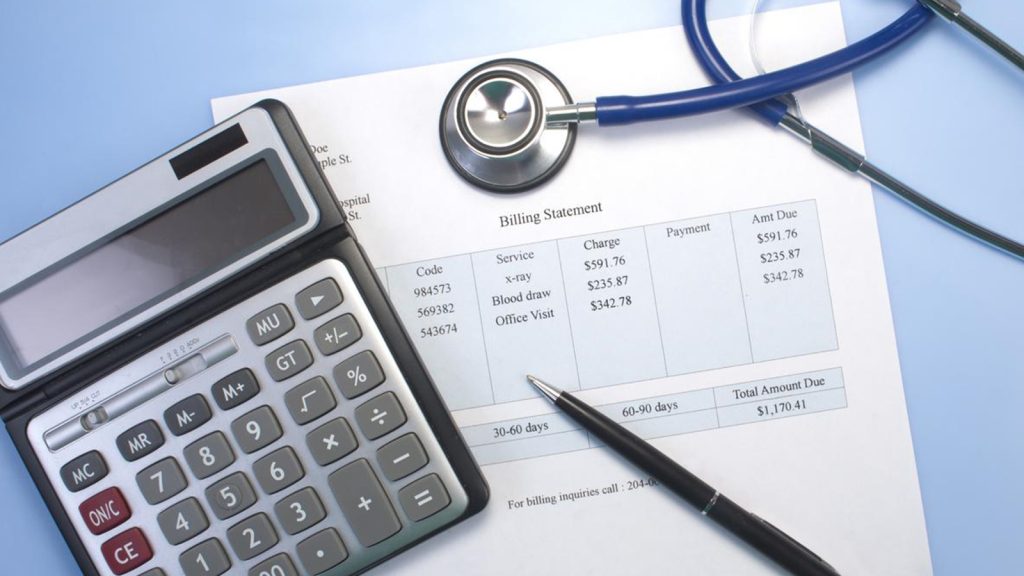

People are often at the losing end when it comes to medical debt. Their quality of life is being compromised because they cannot afford to pay their bills. Medical expenses usually exceed expectations, whether due to an accident, prolonged illness, or even a congenital condition. Even if you have insurance, you still have chances to deal with this kind of debt. Here are some ways on how you can deal with medical debt:

1) REDUCE YOUR OUT-OF-POCKET EXPENSES.

You need not use up all your savings to cover your medical expenses. There are many other options available, like using flexible spending accounts (FSAs), high deductible plans(HDHP), and health savings accounts (HSA). These plans offer tax-saving benefits that can be put to good use when you get sick.

2) WAIT FOR FINANCIAL ASSISTANCE IF NEED BE.

Some hospitals and clinics may provide financial assistance, such as reducing the bill’s overall cost or offering payment possibilities like installment plans. You should ask upfront about these forms of freebies. Even medical providers will negotiate the bill’s terms with you if you are in dire need of help. You can also ask your relatives or friends to share in your expenses.

3) ASK FOR ADDITIONAL DISCOUNTS WHEN INSURANCE COMPANIES DO NOT COVER THE ENTIRE AMOUNT.

Insurance is beneficial in that there are instances where it pays bills entirely. However, some high-cost items are usually not fully covered by insurance plans, so you should talk with the billing department about this matter before paying up.

4) HAVE A PAYMENT PLAN IF NEEDED.

You may have enough money to pay for all your medical expenses right after being discharged, but without extra cash to spare, monthly installment payments might be more practical if this would lessen the burden on you. Many hospitals, clinics, and medical providers offer payment plans; however, your credit score may be affected if you fail to meet the terms of the repayment schedule.

5) WORK WITH A DEBT RELIEF COMPANY THAT CAN HELP YOU DEAL WITH YOUR HIGH-INTEREST DEBTS.

If all else fails, some companies can offer assistance during dire times like this. Debt relief companies make it possible for patients who cannot afford to pay their bills in full to have another option aside from declaring bankruptcy or defaulting on payments which would give them even bigger problems. Some of these companies do not charge any upfront fees, so this is better than doing nothing at all when you’re already under pressure due to medical debt.

CONCLUSION:

While dealing with medical debt may seem like a burden, these solutions will help you in your situation. Make sure to keep in mind what you’ve read to find the best solution for your current circumstances.